HSBC’s Domestic Security Distinct Selection 5

See a low variable introductory rate away from cuatro.74% Apr step 1 into the first year with a brand new HSBC Family Security Distinct Possibilities

Change your residence’s collateral to your a way to obtain finance for family improvements, debt consolidation step three , university fees otherwise significant costs. Rescue of the borrowing from the bank from the down prices than other financing solutions and you can rating a prospective income tax deduction for the appeal you pay cuatro .

Our flexible personal line of credit enables you to use very little otherwise up to need, to your credit limit. In addition it supplies the substitute for arranged the or an excellent part of your own an excellent balance in order to a fixed price loan 6 in a single smoother membership.

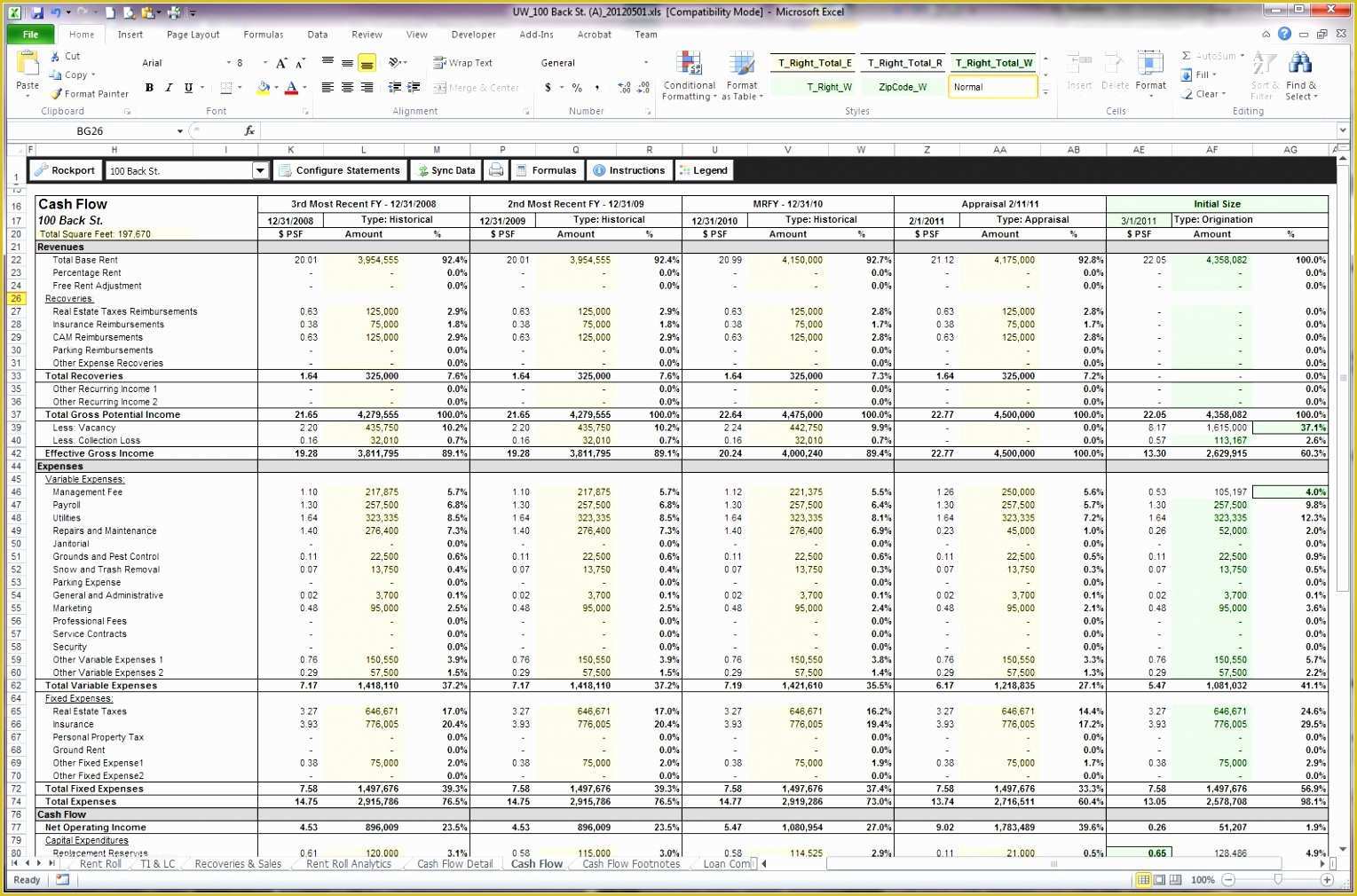

Household Collateral Distinct Choice cost

House Collateral Line of Choices rates: based on HSBC Largest relationship, auto-pay dismiss, sophisticated credit, owner occupied, unmarried house, second Lien HELOC, and you will initially draw disregard dos

Files you will want

- 1 month off pay stubs (most recent)

- One year out of W-2s (current)

- Two years out of Federal Tax returns (1040s), in the event the notice-working otherwise playing with rental earnings in order to meet the requirements

- Home loan report in the event the first mortgage is escrowed

- Most recent possessions taxation otherwise escrowed

- Current home insurance binder

Apr The brand new Annual percentage rate is the annual cost of the mortgage and you may is sold with costs (such home loan insurance rates, most closing costs, discount issues and you may financing origination charges) indicating the total price of the borrowed funds.

*In order to qualify for discounted costs into the a home Equity Distinct Options, payment have to be made thru automatic payment out of an excellent You.S. HSBC checking account hence need to be unsealed and you will fully funded early in the day so you’re able to closure. This Annual percentage rate comes with the original mark write off dos . Savings will likely be cancelled or was susceptible to transform at any big date.

step 1 The new Basic Apr is applicable simply inside the first 12 months in fact it is in accordance with the U.S. Prime Rates (6.25% at the time of ) without 1.51%. Perfect get transform any moment that’s susceptible to transform without notice. In the event the Perfect expands or minimizes when you look at the Introductory Several months, brand new changeable Introductory Apr and you can lowest necessary commission tend to correspondingly alter. Pursuing the twelve day basic rates period the latest Annual percentage rate your existing equilibrium or future improves usually become the fresh new appropriate changeable rate Apr with respect to the regards to your own Arrangement. Which Apr also can will vary monthly based on the You.S. Finest Rates wrote regarding the Money Rates desk of your Wall Street Record. No offers apply at the fresh new Basic Apr.

dos Prices, offers and mortgage numbers confidence specific system that can require particular private deposit and you may resource balances, reserves, collateral and you will automatic commission out-of a keen HSBC U.S. Premier bank account. To own household equity, this new Biggest Apr is sold with a relationship car-shell out write off of 0.25% and very first mark disregard off 0.25% in making good $twenty five http://paydayloanalabama.com/glen-allen,100 minimum very first draw during the closure. 1st Draw disregard and you can HSBC dating automobile-spend dismiss relates to the interest rate after the introductory several months comes to an end.

5 To be eligible for an enthusiastic HSBC Domestic Equity Line of Possibilities you really must have good You.S. Largest relationship. To possess a complete a number of HSBC Biggest Relationship eligibility criteria, please visit otherwise talk to the Matchmaking Movie director.

6 Brand new fixed speed mortgage option gets the capability to enhance the rate on the every otherwise a portion of the a fantastic balance into the draw several months. Up to three balance is repaired at any given time. A lot more criteria apply.

seven Having range amounts of $250,100 or reduced, HSBC pays most of the settlement costs. Basically, closing costs are estimated to are priced between $270 in order to $19,900, but could getting high according to the place in your home and amount of their credit line. If you cancel your account during the first three years, you will need to pay an earlier termination payment of $five-hundred (otherwise $750 for features based in Ca and you can Virginia), along with people financial tax-particularly fees reduced of the HSBC at the time your bank account was dependent. No annual or app charge was analyzed.

8 Being qualified lead dumps are electronic dumps out-of typical unexpected repayments (like paycheck, your retirement, Public Coverage, or any other normal monthly money) placed from the Automatic Clearing Household (ACH) network compared to that membership by your employer otherwise an outside company (please consult your manager otherwise external agencies to decide if the they normally use the brand new ACH community). Lead deposits which do not qualify is but they are not restricted so you’re able to transfers from one account to some other, mobile deposits, or places made within an abundance Cardio or Atm.